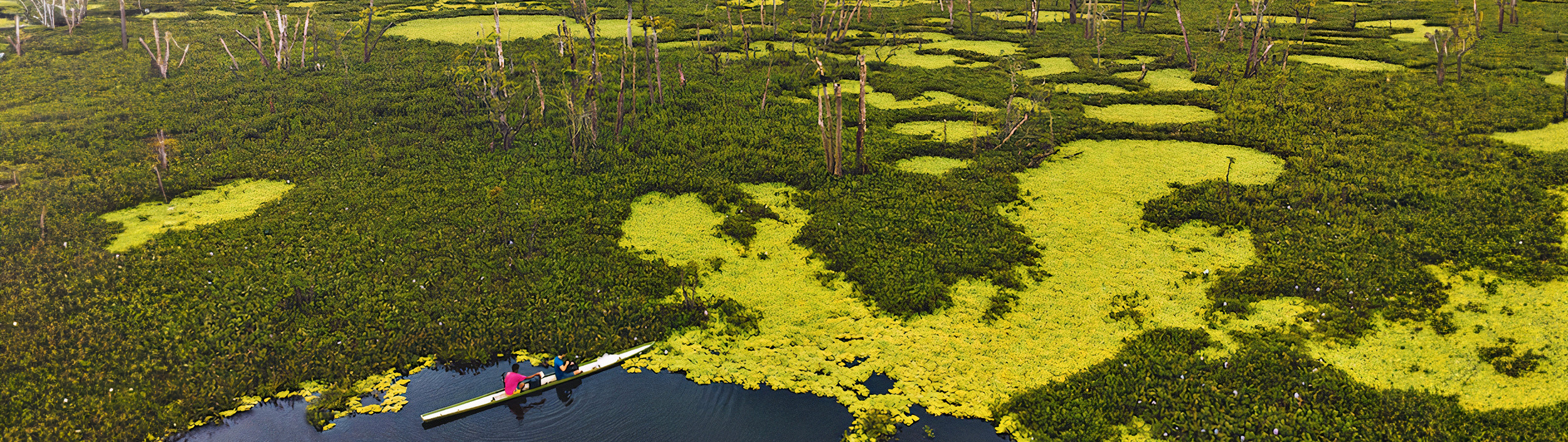

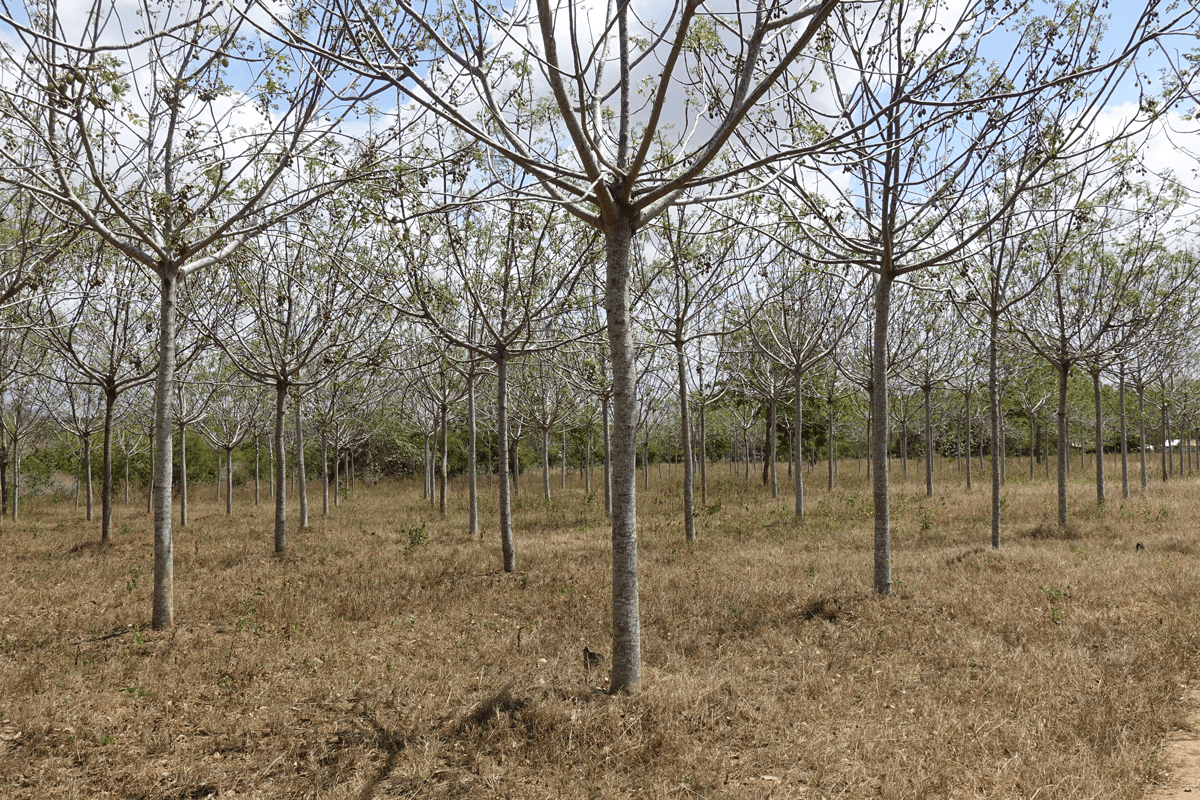

Unlocking billions for climate investments in emerging markets

Meet the 2025 Lab classHow the Lab works

The Lab is an investor-led, public-private initiative that accelerates innovative well designed, early-stage climate finance solutions and instruments.

Learn moreSEPT - DEC

Call for Ideas

The Lab publicizes an open call for innovative sustainable investment solutions.

JAN - FEB

Selection

Lab Members select the most promising ideas to take forward in each annual cycle.

MAR - AUG

Development

Selected ideas benefit from 7 months of analysis, stress-testing, and guidance from experts and investors.

SEP

Endorsement & Launch

Lab Members vote to endorse and launch the ideas for piloting.

OCT - ONWARD

Implementation

The ideas move into action and fundraising to launch pilots, with continued support from the Lab network.

Network

See all Lab MembersLab Members are leaders from public and private organizations who contribute expertise, political support, and financial capital to Lab solutions.

members of our network

Impact

See full reportThe Lab develops innovative, catalytic ideas for financial solutions that can accelerate climate-related investments in emerging economies.

0

instruments

launched to tackle barriers in the most critical sectors and regions

$

0

bn

mobilized for climate action in emerging economies

$

0

bn

invested by the Lab Network

$

0

bn

invested by private investors

Lab Portfolio

View all ideasTestimonials

Winner 2021

Financing for Climate Friendly Investment

News and Events

View all

These mechanisms drive climate investments in emerging markets, supporting sustainable development....

Strata’s páramo insurance was featured in El País as a standout solution in climate adaptation....

Publications

View all

The report takes stock of current practices in the gender-responsive climate blended finance market....