About

Only 46% of the population in Sub-Saharan Africa has access to energy. Despite progress at the continent level, where the number of people without access to electricity fell by 30 million between 2013 and 2019, fragile states in Africa suffer from persistent energy poverty and low investments in the sector.

Renewable energy is one of the most cost-effective ways of scaling electrification, but uncertain political and economic environments deter both domestic and international public and private sector investors, severely constraining access to finance for renewable energy project developers. Even developers with offers of infrastructure finance frequently struggle to access these facilities due to the equity required to release the flow of debt capital.

The P-REC Aggregation Fund is raising USD 10.25 million in first loss grants and impact investments to help unlock up to USD 90 million in new renewable energy investment in fragile states

INNOVATION

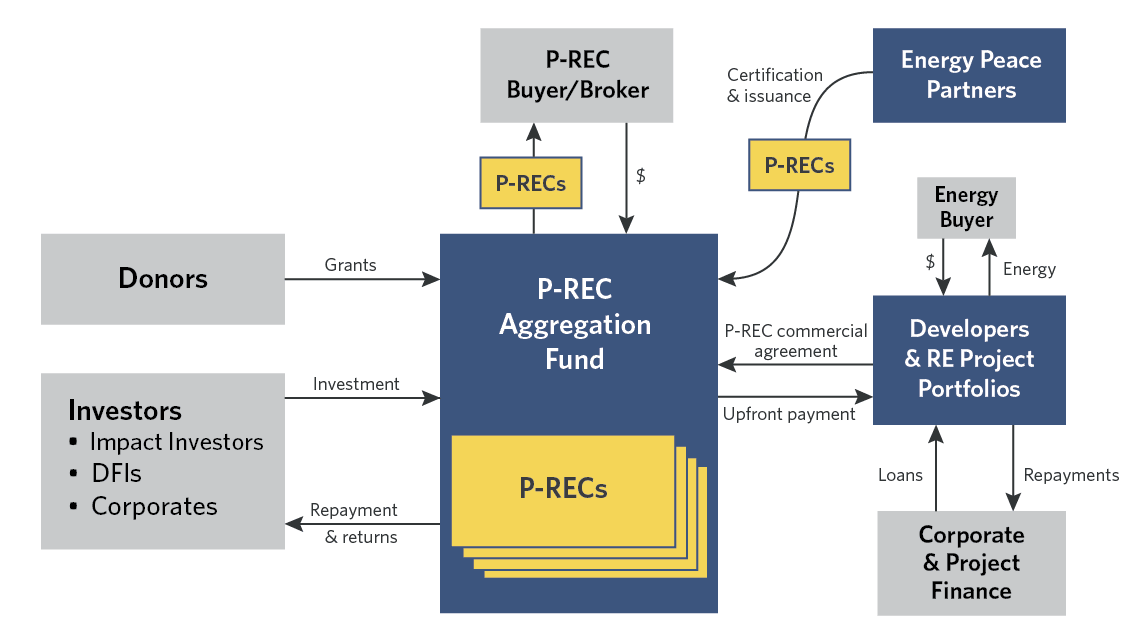

The Peace Renewable Energy Credit (P-REC) Aggregation Fund monetizes environmental and socio-economic attributes of renewable energy projects to provide developers with an additional revenue stream, enabling access to term finance.

P-RECs are a high-quality type of I-REC (International Renewable Energy Certificate) generated by projects in climate-vulnerable, energy-poor, fragile countries. Each P-REC represents one megawatt-hour of renewable energy generated, but with an additional label certifying the peacebuilding co-benefits of the project.

The fund will tap into the growing voluntary market for energy attribute certificates, especially popular among international corporations, including the 300+ corporate members of the RE100 initiative. In 2020, Microsoft and Google respectively executed the first P-REC sales agreements to support high-impact renewable energy projects in the Democratic Republic of the Congo.

“As we build our pipeline of P-REC projects in DRC and other fragile, energy-poor countries, we see many viable renewable energy projects that struggle to raise capital. The P-REC Aggregation Fund can close this gap. The Lab provided crucial modeling, structuring, and other advisory support that will help us scale the P-REC Aggregation Fund,” – Katie Retz, Energy Peace Partners

IMPACT

A pilot of USD 10.25 million is projected to unlock up to nine times more capital (up to USD 90 million), supporting the addition of 57 megawatts of new renewable energy capacity in high-impact countries.

Over the first 10 years of plant operation, this will generate more than 800,000 P-RECs to be sold on global markets, enabling the extension of the renewable energy revolution to underserved communities, and supporting the achievement of UN Agenda 2030, including SDG 7 (energy access), SDG 13 (climate action), and SDG 16 (peace).

This new flow of capital will mean energy access to 325,000 households, 10,000 jobs, and 650,000 tons of greenhouse gas emissions avoided.

P-REC Aggregation Fund planned pilot is expected to generate 57 megawatts, providing energy access to 325,000 households

DESIGN

The fund will provide upfront P-REC revenue to project developers equivalent to approximately 10% of the construction costs in exchange for the ownership of the P-RECs generated by the project over a determined period, typically the first ten years of operation. To minimize risks, 50% of the fund will consist of first loss grant capital.

The transaction is based on a forward purchase commercial agreement concluded before construction, to enable the developer to secure the necessary construction and/or term finance or start repayment of these construction loans. The commercial operation date of the RE system triggers the payment from the fund before the energy is generated and the associated P-RECs are issued.

Once construction is finalized, the fund will apply directly for certification and have the P-RECs issued by EPP as energy is generated. Certified P-RECs are then aggregated at the fund level and traded on voluntary markets via advance or spot purchase agreements directly with buyers or through intermediary energy brokers. The aggregation function of the fund allows for cross funding of various projects and so operational flexibility.

Top photo credit: Nuru