About

Biogas is a renewable non-intermittent energy source with the potential to produce up to 40% of Brazil’s energy demand and replace 70% of its diesel consumption. However, the country’s current biogas capacity of 300 MW is highly concentrated in projects developed by large groups. This limits the expansion of biogas: it represents less than 0,1% of the energy mix.

On the other hand, there is an ecosystem of independent developers operating in more flexible business models, who could unlock substantial volumes for the sector. An assessment of these developers points to double the country’s capacity within 2 years. Although credit lines are plenty, independent biogas project developers are limited by guarantee requirements from lenders, who often demand real-estate or cash guarantees of up to 120% of the loan value.

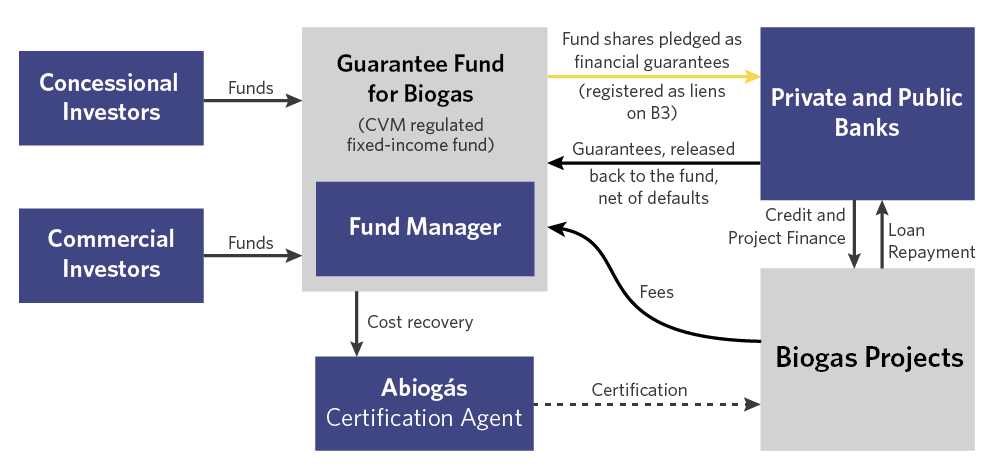

The Guarantee Fund for Biogas (GFB) is the first environmental-oriented guarantee fund in Brazil. By providing short-term collateral for biogas project loans, it unlocks public and private finance as a promising renewable energy source in the country.

INNOVATION

The GFB is the first environmental guarantee fund in Brazil targeting private investors that seek to leverage existing credit lines for biogas projects. It is an opportunity for investors to not only foster biogas adoption in Brazil but also kick-start the country’s market for environmental guarantee funds.

A blended finance structure helps keep fees low for developers, while still providing market returns for senior tranche investors. The substitution of real-estate collateral for quasi-cash guarantees enables lower interest rates on debt operations.

“Brazil has the highest potential in the world for biogas. However, due to a lack of knowledge about the financial aspects of biogas projects, the perception of risk by banks and financial institutions is too high. The Lab’s expertise will help us design and launch an attractive, workable financial product,” – Alessandro Gardemann, President, ABiogas

IMPACT

The pilot fund targets agriculture waste inputs to enable an initial loan portfolio of USD 67 million, which will reach up to USD 258million in 10 years. The pilot will enable 43 projects and is expected to mitigate up to 331,000 tons CO2e per year over its first 10 years.

Individual project guarantees, capped at 10% of each project, will range from USD 530,000 to USD 6 million.

At scale, the instrument is expected to mitigate three times as much, while the replicated portfolio (addressing 10% of the Brazilian biogas potential) would reduce emissions by 7.8 million tons CO2e per year

DESIGN

The GFB will be set up as a closed fixed-income fund (art. 113 of CVM Instruction nº 555), investing solely in Brazilian treasury bills and pledging its shares as collateral. The fund will invest up to 100% of its resources on Brazilian treasury bills, ensuring a sovereign-level risk to underlying assets.

For each operation, the fund will charge a yearly fee from biogas developers, which will be its main source of revenue. In return, the fund will pledge its shares as financial guarantees for project loans.

The fund will provide yearly yields for senior tranche investors, while concessional investors are expected to be repaid only at the end of the fund’s 10-year lifespan. Due to the revolving nature of the guarantees, during these 10 years, the fund will be able to pledge its resources many times over. That, combined with the fund’s ability to leverage up to three times its resources once a track record is established, means the fund has the potential to generate an increasingly higher impact on the sector.