Decentralized renewable energy is one of the most cost-effective ways of scaling electrification, but due in part to stagnating investments in the space, the rate of energy access is increasing at an anemic rate.

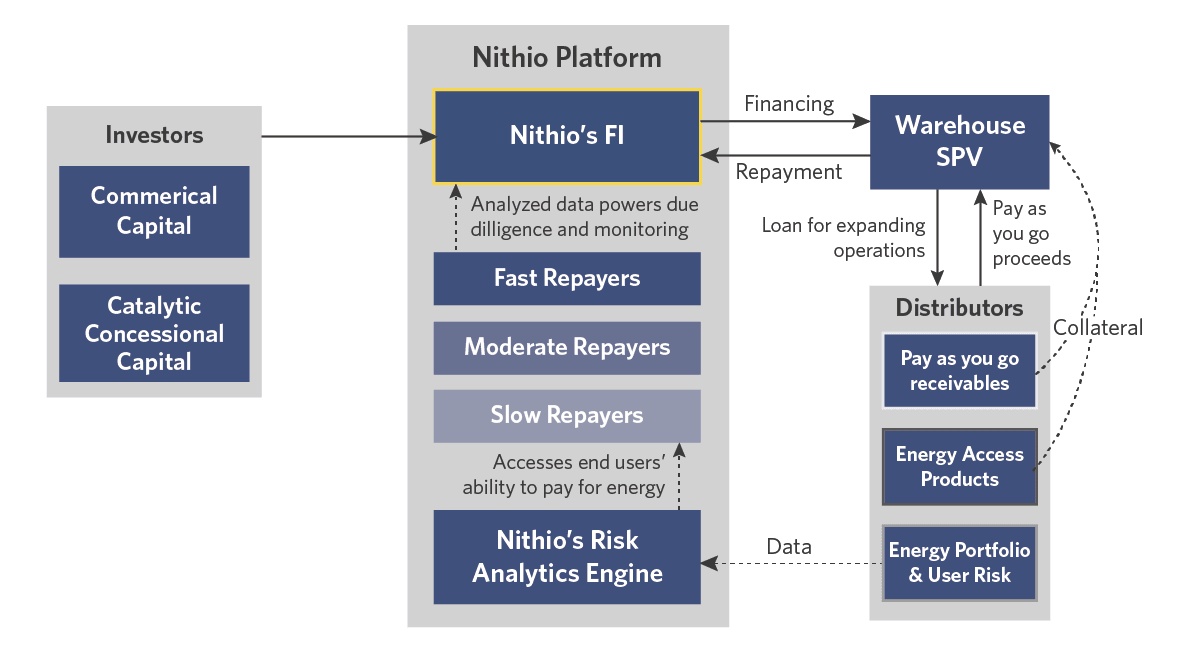

A significant barrier to scaling decentralized RE is the inability to properly assess customer repayment risk. This data gap limits distributors’ ability to raise capital, especially for small and mid-sized, local providers, who have strong distribution networks but cannot affordably access debt.

Donor capital is achieving limited success in its mission to leverage private finance. Concessional capital does not always enable distributors to reach last mile customers because without data on household ability to pay these funds are applied across a project instead of being targeted to those who need it most.