One reason for this is that current sustainable value chains lack productive capacity, infrastructure, and financing, and cannot compete with value chains that are often associated with deforestation (beef, soy, wood). Adequate financing, technical assistance, and investment in enabling conditions can build forest-compatible value chains in the Amazon, allowing for cooperatives to take advantage of the growing market demand and eliminating pressure to deforest.

About

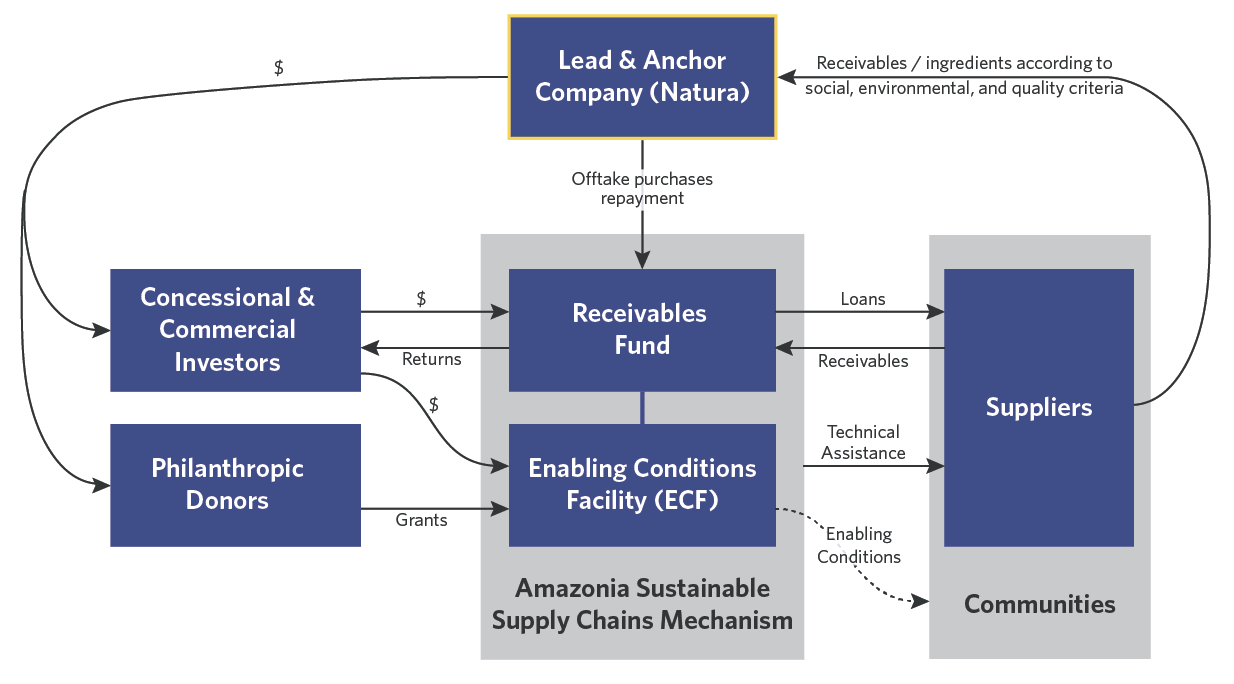

The Amazonia Sustainable Supply Chains Mechanism leverages off-take agreements for forest-compatible products to provide upfront finance, technical assistance, and structural community resources that catalyze the bioeconomy and keep forests standing.

INNOVATION

The Amazonia Sustainable Supply Chains Mechanism (AMSSC) offers an opportunity for companies to take on a role traditionally held by financial institutions, but in a way that brings more value-add to suppliers and optimizes the potential of the entire ecosystem.

AMSSC is unique in having the participation of the fund manager and a strong off-taker in the structuring of the fund, as well as having the off-taker investing in the fund with skin in the game and purchasing from the communities, with a long-term perspective.

“The Lab was a crucial partner for refining and stress-testing our proposed solution, so that we can launch a robust, replicable, and scalable financing mechanism to develop resilient and sustainable supply chains in the Amazon and other similar regions,” – Carolina da Costa, Partner, Mauá Capital.

IMPACT

The instrument will pilot as a USD 50 million fund, financing up to 34 cooperatives in the Amazon region. It will start financing suppliers of 39 different ingredients, with the objective of expanding to 55 bioingredients from the Amazon Forest. Natura expects its bioingredients off-taking to reach approximately USD 12 million (BRL 60 million) by 2030.

The pilot’s goal is to keep three million hectares of forests standing in the Amazon by 2030 (equivalent to Belgium). With that, AMSSC can contribute to reducing the pressure to deforest this land, and thus avoid a potential 1.4 billion tons of CO2 emissions (almost 400 million tons of carbon).

DESIGN

AMSCC has two components:

A receivables fund that pays suppliers upfront in exchange for receivables, with the off-taker then repaying the fund for the products purchased. The off-taker also participates in the subordinate tranche of the receivables fund.

And an enabling conditions facility (ECF) to improve suppliers’ capabilities to deliver quality products and ramp up their production capacity. The ECF also provides a broader set of investments to communities, including in education, healthcare, access to the internet and infrastructure, to contribute to their sustainable development.

The instrument uses a blended finance structure, with Natura acting as the initial off-taker and investor to the fund’s subordinated tranche. Natura’s presence catalyzes the participation of others in the fund, including other off-takers who can invest in both the receivables fund and the ECF.

AMSCC provides a new model for corporate responsibility, where companies play an active role in not only guaranteeing the quality of their supplies but also supporting the communities of their suppliers.