By Maria Ruiz and Guillermo Martinez

April 10, 2024

Latin America and the Caribbean (LAC) can be a major source of solutions to address climate change, as it hosts critical ecosystems and vast natural resources that are key to advancing the global energy transition and providing carbon sequestration at scale. However, the region receives only a small fraction of global climate finance flows. Programs like the Global Innovation Lab for Climate Finance aim to contribute to finding new ways to attract investment to the region.

The imperative to reach net zero emissions and build climate resilience has never been greater. The need for action intensifies as we race towards the deadline of many vital climate goals in 2030. The National Oceanic and Atmospheric Administration (NOAA) confirmed 2023 as the hottest year on record, adding urgency to calls to deliver on global climate initiatives and to set more ambitious binding commitments from countries, as expected at COP28. The conference made clear that finance is crucial for enabling climate action.

While climate finance flows reached a significant milestone of over USD 1 trillion on average annually for the first time in 2021 and 2022 (as per Climate Policy Initiative’s latest Global Landscape of Climate Finance), estimates suggest a fivefold increase is necessary within the next six years.

LAC climate finance flows accounted for only 4% of total climate finance between 2021 and 2022 (USD 52 billion). This is strikingly low, given that estimates indicate that USD 215-284 billion are required annually from 2023 to 2030 to finance a low-carbon and resilient transition in the region.

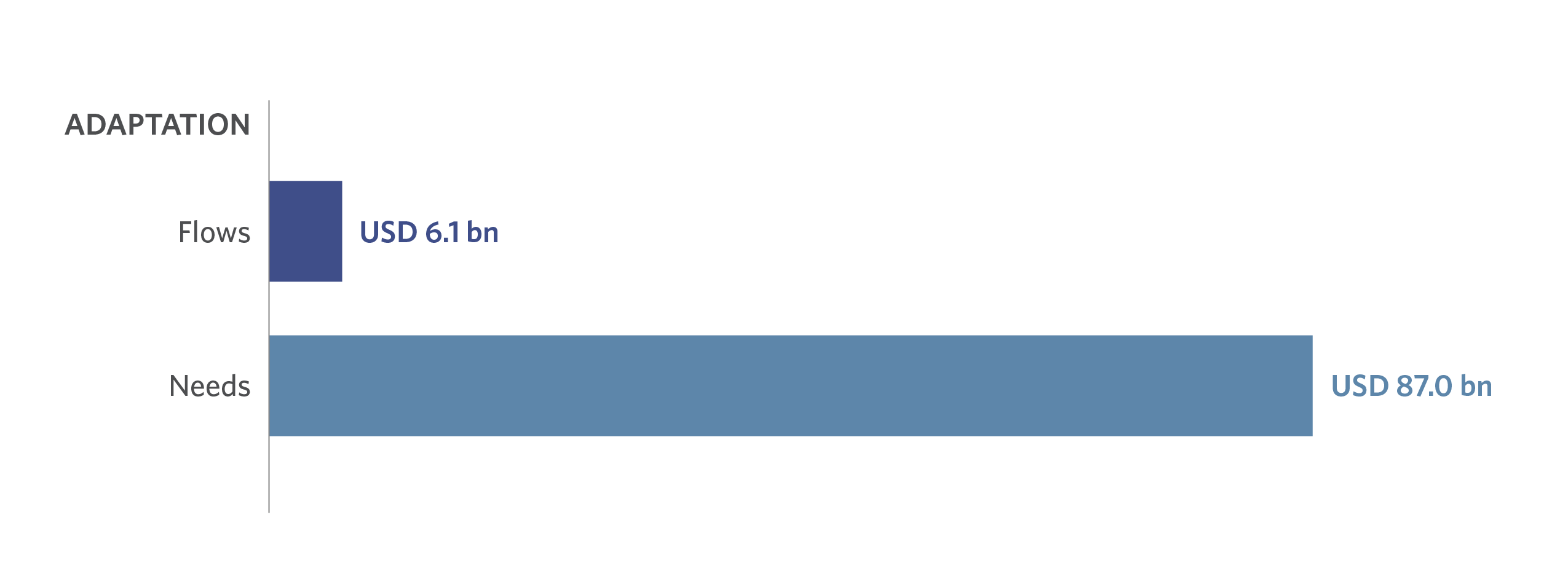

An analysis of the distribution of climate finance within Latin America reveals a significant imbalance between mitigation and adaptation efforts, with total finance flows falling considerably short compared to estimated needs. Adaptation funding, totaling USD 6.1 billion, represents only 12% of the region’s total climate finance and remains far below the estimated annual requirement of USD 87 billion on average for 2023-2030 (Figure 1).

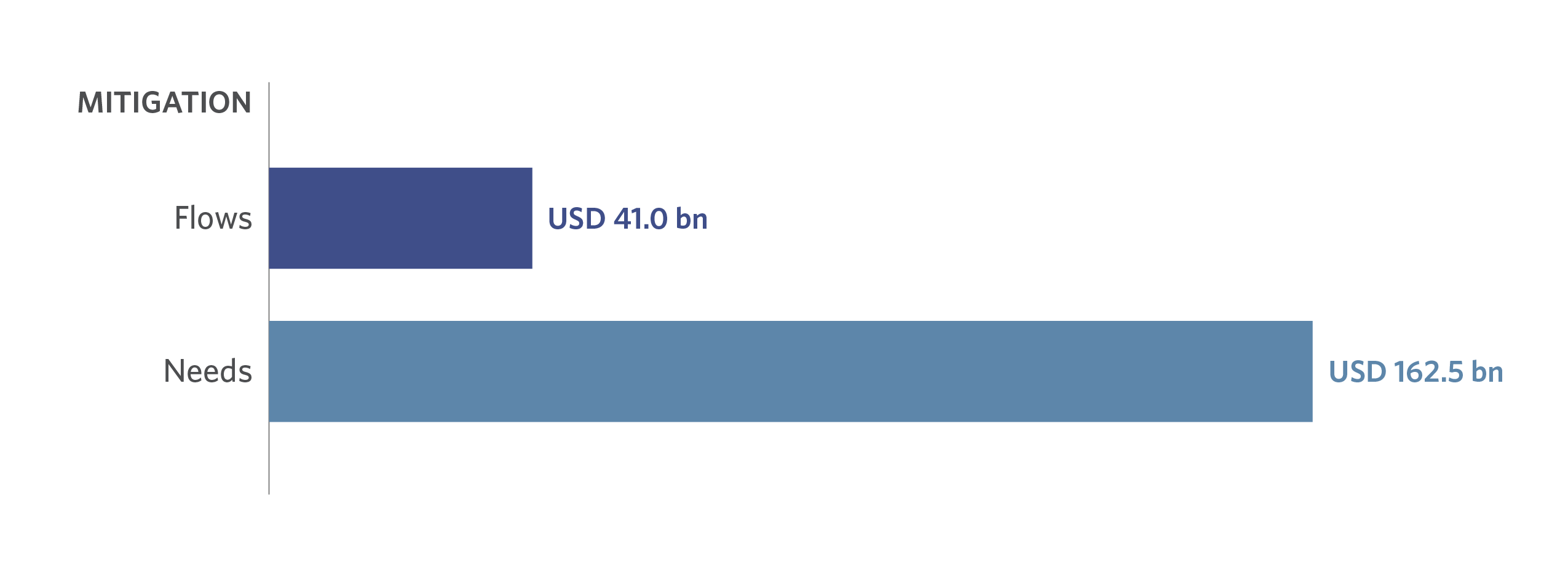

Similarly, mitigation efforts, averaging USD 41 billion in 2021-2022, fail to meet the estimated annual need of USD 162.5 billion on average (Figure 2).

This is concerning given the high vulnerability of several LAC countries — especially those in Central America and the Caribbean — and the expectation of speeding up the energy transition in countries with vast fossil fuel and mineral reserves.

Like other emerging markets, the climate finance gap in LAC can respond to several structural obstacles to securing investment. These include:

(1) Mismatch in Financing: There is a gap between the type and scale of the financing needed and the capital being deployed. Investors focus on debt offerings rather than equity investments, and investments are often too large for the needs of climate projects in most countries in the region. This leads to a concentration of funds in bigger economies and sectors, usually favoring mitigation over adaptation projects.

(2) Lack of Local Financial Institutions’ Awareness: While there has been some progress in sustainable finance in the region in the last few years, local financial institutions still lack the awareness and technical knowledge to leverage climate finance effectively. Current efforts related to climate change have focused on strategies like engaging with corporations and measuring portfolio-financed emissions. Yet, there is still room for creating climate-focused investment strategies that better channel capital towards a successful transition.

(3) Risk Aversion: Financial institutions in LAC tend to have conservative investment approaches, hesitating to explore asset classes that are either new to them or in their early stages. This emphasizes the need for concessional capital to de-risk investments in specific sectors to unlock private capital flows. Similarly, international private investors usually perceive LAC as a niche and high-risk region, which leads to lower exposure and a concentration in larger economies like Brazil and Mexico.

The path forward for Latin America and the Caribbean regarding climate finance is also full of potential. Recent supply chain disruptions have garnered international investors’ interest in the region, as businesses operating in North America prioritize nearshoring from countries like Mexico over traditional East Asian markets. Additionally, the region’s abundant natural resources coupled with escalating public commitments to increase clean energy — as evidenced by the Renewable Energy in Latin America and the Caribbean (RELAC) initiative, under which 15 countries have pledged to source 70% of their electricity from renewable sources — signal the robust potential for a low-carbon and resilient transition, uniquely positioning the region to provide global climate mitigation solutions.

The Global Innovation Lab for Climate Finance offers a promising opportunity for mobilizing climate finance through its new LAC regional program. This global public-private initiative has been crucial in developing innovative finance instruments in emerging economies. Since its inception in 2014, it has launched 68 instruments and mobilized approximately USD 4 billion — of which USD 1.4 billion was catalyzed from the private sector. Through blended finance strategies, The Lab aims to reduce investment barriers and enhance the role of local institutions in climate finance initiatives. In 2024, the new LAC regional program will incubate one mitigation and one adaptation instrument with the potential to mobilize much-needed climate finance for the region.