Amsterdam, 14 March 2024 – The Global Innovation Lab for Climate Finance (the Lab) is introducing its historic 10th cohort poised to deploy innovative finance solutions to scale up mitigation and adaptation action across the Global South.

This group of ten solutions—the largest Lab cohort to date—seeks to build on the USD 4 billion that Lab alumni have mobilized to date. The Lab will support seven ideas from five regional programs (East and Southern Africa, Brazil, India, Latin America and the Caribbean, and the Philippines) and three global thematic areas: sustainable agriculture and food systems, high-integrity forests, and climate adaptation.

“This year, we are expanding the Lab’s reach to address historically underfinanced and particularly vulnerable regions and thematic areas,” said Dr. Barbara Buchner, Global Managing Director of Climate Policy Initiative. “By addressing everything from nature-based solutions in the Philippines to monetizing high-integrity forests in the tropics, we are exploring how to demonstrate the potential of innovative ideas while also working with entrepreneurs who can mobilize climate finance at the speed and scale needed.”

Selected ideas will receive seven months of stress testing and guidance from experts within the Lab’s extensive network of public and private investors.

“Expanding the Lab from six to ten instruments reflects the momentum that the Lab has built in helping innovative, early-stage ideas move from concept to market, as well as the wider need to scale bankable investment models across climate themes and regions,” said Ben Broché, Climate Policy Initiative’s Associate Director who leads the Lab’s efforts. “We’re confident these solutions will put us on a path to break through the USD 5 billion mobilization figure soon.”

In 2024, the Lab celebrates its tenth anniversary, welcoming its largest-ever class. This year sees the addition of two new regional programs — one in Latin America and the Caribbean, and another in the Philippines.

“Nature-based solutions are key to bridging the biodiversity finance gap and building a nature-positive world, as well as meeting our international climate finance targets. With Canada’s support, the new program in the Philippines will help demonstrate that nature-based solutions offer catalytic potential both in the region and worldwide,” said Floradema Eleazar, UNDP Climate Action Programme Team Leader.

Selected ideas

Amazon Food&Forest Financing Initiative empowers local businesses and fortifies sustainable value chains in the Brazilian Amazon. Through a blended credit facility, Impact Bank and The Nature Conservancy are working to extend credit lines and fair loans to local MSMEs complemented by a technical assistance facility.

Clean Utilities for Affordable Housing is a servitization model offering sustainable utility services to residents of affordable housing developments in South Africa through a fund that owns and operates the equipment. The fund partners with affordable housing landlords, providing off-take guarantees to derisk the vehicle. Mzansi Clean Energy Capital is the proponent.

Growth Next-Generation Agriculture is a debt facility that uses AI to connect lenders with innovative companies developing organic fertilizers, cover crops, and other sustainable solutions in Brazil. Traive Finance and Instituto Folio lead the instrument.

InvestHER Climate Resilience Bond is a groundbreaking social bond to empower women-led adaptation-focused agri-SMEs in Uganda. Grameen Foundation is the instrument’s proponent.

Model Forests and Biodiversity Bond is an innovative approach to green corporate bonds by Forest Carbon, supporting accredited developers of forest conservation projects in Southeast Asia and the Philippines.

Regenera Ventures Fund is a women-led investment fund developed by SVX Mexico. It invests in companies that contribute to the regeneration of Mexican ecosystems. The fund focuses on rural companies committed to nature-based solutions.

Resilient Municipal Market Fund (ReMark) is a blended finance facility presented by ICLEI Africa, targeting urban food markets in Africa to reduce food waste, improve food security, safeguard vulnerable livelihoods, and reduce emissions.

SPV for Silvopasture Scaling is a special purpose vehicle (SPV) to provide long-term financing and technical assistance for cattle farms to transition to silvopastoral systems in Colombia. Repayments will come from profit-sharing flows from productivity gains and the issuance of high-quality carbon credits. The Nature Conservancy is the proponent.

Sustana Cooling Impact Fund is a blended capital equity fund supporting early-growth companies delivering cooling applications. Backed by Sustana Cooling Partners LLC and Climake, the fund addresses the urgent need for climate adaptation in emerging markets facing rising temperatures.

The Landbanking Group is a nature fintech that brings nature to the balance sheet. The proponent built the first natural capital management platform and issues Nature Equity Asset Purchase Agreements between natural capital providers (land stewards) and buyers.

Ten additional ideas made it to the final stage of the Lab. They are:

- Capital and Capacity for Community Climate Champions, Nobon

- Community Equity Opportunity Fund, Meliquina Partners

- Indonesia Intact Rainforest Fund, World Resources Institute

- Just Finance, Sangam Ventures

- Rice Resilience Bond, AgriG8

- Sarona Climate Action Incubator, Sarona Asset Management

- S-DEA: Securitisation with Digital Environmental Assets, LandPrint and OPEA

- SIDS and Coastal LDCs Appropriate Technology Facility

- Utopia Climate Adaptation Initiative, Utopia Climate Management, The Radical Fund

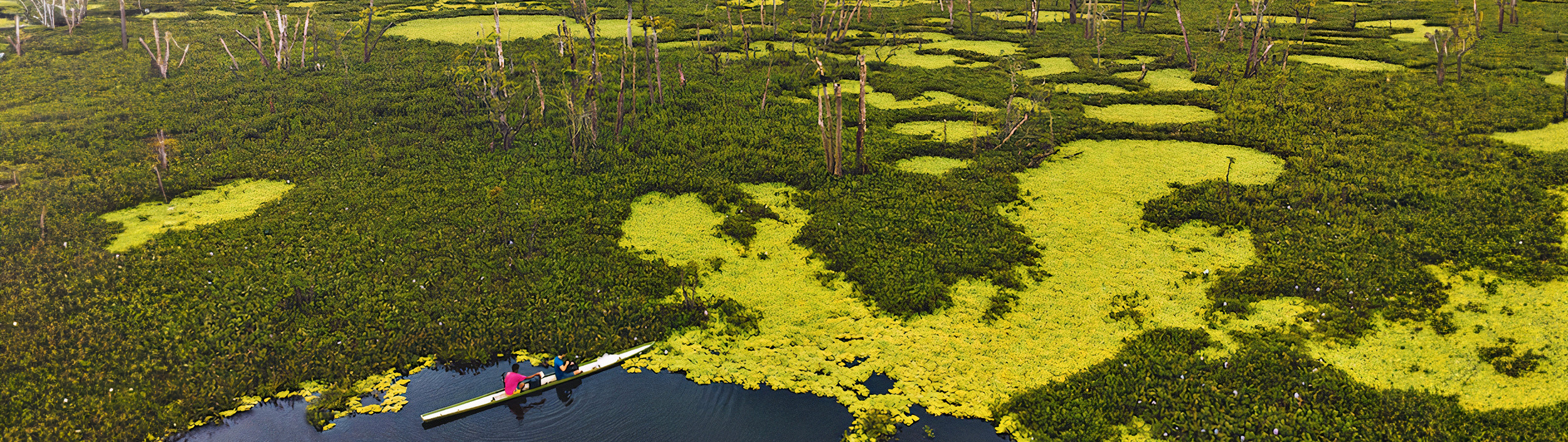

- Vitória-Régia Fund (VRF), Guarana Bank

About the Lab

The Global Innovation Lab for Climate Finance identifies, develops, and launches innovative finance instruments that can drive billions in private investment to action on climate change and sustainable development. Bloomberg Philanthropies, the United Nations Development Programme (UNDP), and the governments of Canada, Germany, the United Kingdom, and the United States fund the Lab’s 2024 programs. Climate Policy Initiative serves as the Secretariat and analytical provider.

Contact:

Júlio Lubianco

Communications Manager

julio.lubianco@cpiglobal.org

Sam Goodman

Communications Associate

sam.goodman@cpiglobal.org