Impact Earth is launching the Tropical Resilience Fund (TREF), starting from the Amazon Biome area and expanding into the broader Tropical Belt. TREF will deploy capital through revenue-based finance, convertible debt, and environmental assets bridge loans, targeting a 10% internal rate return (IRR). The Fund will focus on three thematics from resilient economic value chains, landscape resilience, and financial enablers.

ABOUT

Tropical ecosystems face unprecedented nature loss in part due to climate change, however investments in nature historically fail to sufficiently account for climate risk. Consequently, financing for early- and growth-stage projects and ventures that both protect ecosystems and adapt to the impacts of climate change is needed.

High perceived risks, long payback periods, and relatively high transaction costs have discouraged commercial and impact investors from engaging at the early and growth stages. The Tropical Resilience Fund (TREF) addresses this barrier by deploying risk-tolerant capital to projects that protect ecosystems and strengthen vulnerable value chains, supporting scalable business models that deliver strong environmental outcomes and generate tangible economic opportunities for local communities.

INNOVATION

TREF provides risk-tolerant capital to projects and enterprises that protect nature and strengthen resilience in climate vulnerable value chains. By leveraging local teams and targeting scalable solutions, TREF bridges the financing gap that has historically deterred investor engagement. It supports business models that not only deliver strong environmental outcomes but also generate meaningful economic opportunities for local communities.

By applying to the Lab, Impact Earth can further leverage lessons from the Amazon Biodiversity Fund to test its science-based approach, enhance credibility, gain expert guidance, and access potential investors.

Vincent Gradt, Co-Founder and Managing Partner, Impact Earth.

IMPACT

TREF will launch with a first close of USD 30 million, beginning capital deployment in Latin America and later expanding to Southeast Asia and other select regions. With a target final close of USD 100 million, the Fund supports projects and ventures that protect tropical ecosystems, foster sustainable local economic opportunity, and build investee and local population resilience. To measure progress toward this goal, the Fund will track five core, fund-level metrics that reflect its climate, nature, and socioeconomic impacts.

DESIGN

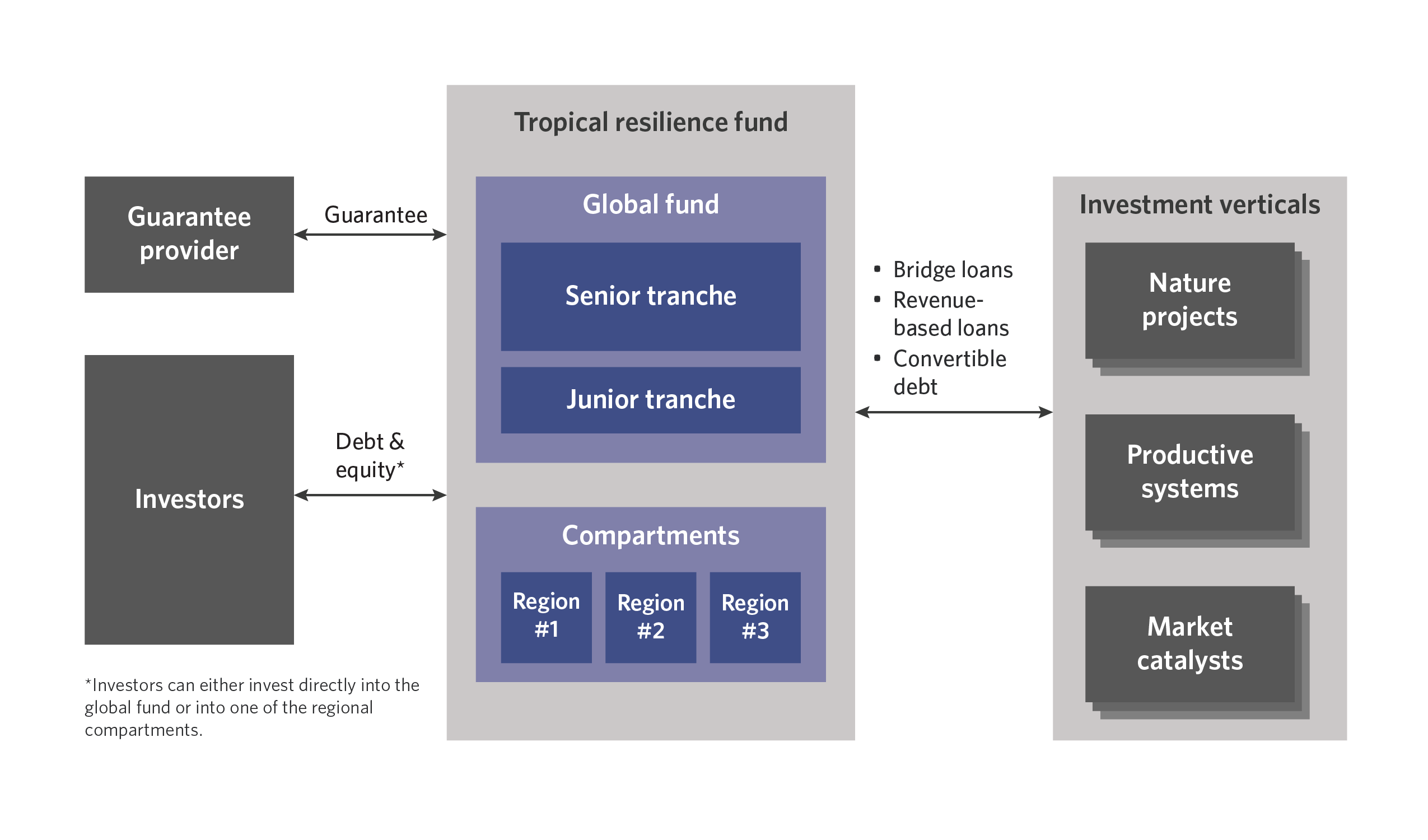

TREF is a USD 100 million closed-ended mezzanine debt fund designed to scale nature-positive, climate-resilient solutions. It provides revenue-based loans, convertible debt, and bridge loans to early- and growth-stage ventures and nature projects. Investors may allocate capital through the global fund or via regional compartments, such as the Amazon Basin or Southeast Asian tropical forests.

With a 12-year term and two potential one-year extensions, TREF uses a blended structure to attract commercial capital while reducing risk. Senior tranche investors are expected to include institutional investors, DFIs, and impact funds, while philanthropies and governments will anchor the junior, first-loss tranche, potentially alongside DFIs. A 70:30 senior-to-junior split.

Risk mitigation will combine regional diversification, a first-loss layer, and potentially a guarantee facility applied to the portfolio or select verticals. Returns will be generated through loan repayments and equity conversions from convertible debt, with TREF targeting a net IRR of 10% while enabling ventures that strengthen ecosystems and create local economic opportunities.