The Seeded Initiative funds native seedling nurseries in Brazil, ensuring financial stability through guarantees and long-term purchase agreements. By providing reliable funding, it enables large-scale forest restoration and sustainable farming. This scalable approach strengthens reforestation efforts, secures a steady seedling supply, and promotes environmental conservation and sustainable land use.

ABOUT

Brazil has set ambitious climate and biodiversity goals, committing to restoring up to 24 million hectares of native vegetation by 2050. Restoration through nature-based solutions, such as reforestation and agroecological systems, could remove 72–144 million tons of CO2 annually, making it a central component of Brazil’s path toward climate neutrality. Yet, the country faces a critical supply bottleneck: seeds and seedling production. Brazil produces only 200 million seedlings per year, far below the one billion needed. Nurseries, key to scaling restoration, are undercapitalized and lack access to tailored finance. With no collateral, seasonal cash flows, and fragmented markets, they struggle to make ends meet with little to no access to working capital, while also being in need to expand capacity in order to meet rising demand. Without access to capital, nurseries will not be able to supply seedlings at scale, hence hampering ecological restoration in Brazil.

INNOVATION

The Seeded Initiative introduces a first-of-its-kind financing model targeting native seedling nurseries in Brazil. Unlike existing tools focused on landowners or project developers, it channels capital directly to input providers through receivables-backed credit, blended finance, and performance-based de-risking. This tailored structure aligns with nurseries’ seasonal cash flows and fragmented markets, while promoting formalization and structured contracts with buyers. The initiative creates a scalable, investable asset class that can unlock seedling supply, catalyze restoration at scale, and deliver lasting climate and biodiversity outcomes.

To unlock Brazil’s restoration potential, we must secure financing and off-take guarantees for native nurseries — precisely what our solution delivers by providing reliable funding and operational support, empowering nurseries to produce high-quality seedlings, and paving the way for large-scale ecological restoration success.

Daniel Jimenez, CEO, Silva.

IMPACT

The Seeded Initiative will roll out in phased stages, beginning with up to 20 nurseries to validate tailored financing models for working capital and infrastructure. These pilots will generate critical data on rates, risks, and operational needs, laying the foundation for a scalable vehicle. Over time, the instrument will evolve from a concessional-heavy structure to a commercial facility capable of mobilizing BRL 250 million (USD 46 million). At scale, it could support one billion seedlings annually, restoring up to one million hectares, contributing to the removal of 8.6 to 18.3 million tons of CO2e per year, and delivering significant benefits to biodiversity and rural livelihoods.

DESIGN

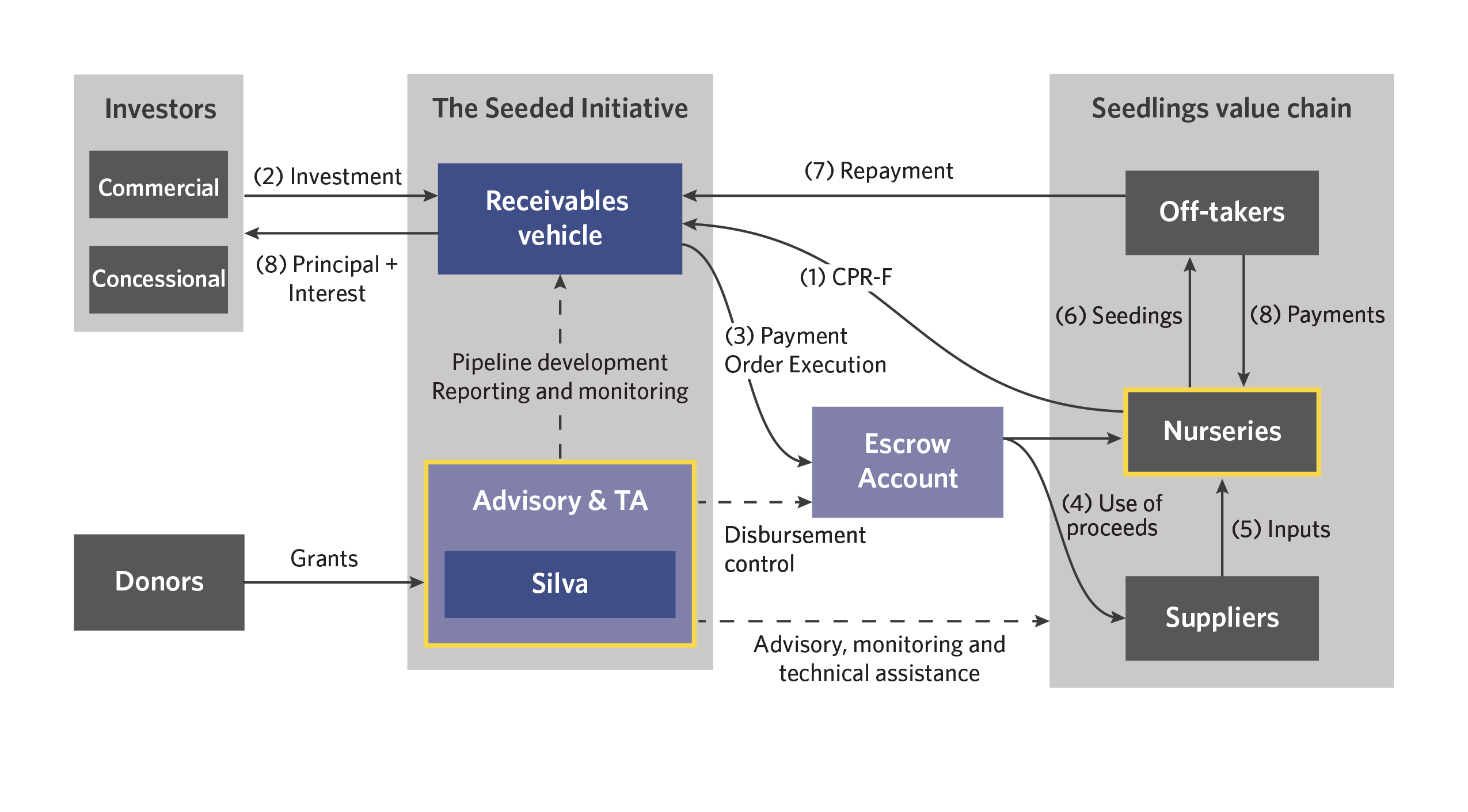

The Seeded Initiative uses a revolving debt structure that combines risk mitigation with predictable cash flows. Nurseries formalize seedling sales agreements with offtakers and input supply contracts with pre-approved suppliers, creating legally enforceable cash flow commitments. These contracts underpin the issuance of debt instruments, which are assigned to a receivables vehicle that will hold the corresponding credit. Investors subscribe to certificates backed by these receivables, providing working capital while reducing entry barriers for nurseries.

Funds are managed through an escrow account, ensuring that disbursements to suppliers align with production plans. As seedlings are delivered and receivables repaid, the cycle generates returns for investors while supporting nursery operations, allowing them to scale output, diversify species, and improve quality. A dedicated Technical Assistance facility monitors compliance, operational performance, and environmental impact, ensuring the instrument achieves both financial and ecological outcomes.