The Lendable Decarbonization Fund (LDF) pioneers sustainability-linked loan solutions, reduces costs, boosts transparency using MRV tech, and supports carbon project preparation where appropriate.

ABOUT

Only one third of total climate finance flows to emerging economies, excluding China. It is crucial to avoid locking in emissions in sectors such as transport energy and agriculture. At the same time, investors increasingly urge their investees to adopt sustainable practices in this region but focus on avoiding greenwashing.

INNOVATION

Developed in response to a pressing concern about the lack of access to sustainability-linked financing for emerging market enterprises, LDF serves this largely overlooked market. LDF was designed to overcome the principal barriers, such as information gaps, pricing, and administrative costs for borrowers that obstruct the flow of funding for sustainability and decarbonization efforts. Lendable’s proprietary, commercially proven Maestro technology is a core enabler of its strategy. Its impactfocused client base uses it as a top-of-the-line digital MRV tool.

“Decarbonizing equitably is our generation’s most urgent problem that requires the collaboration of many types of entities to do so. Initiatives like the Lab help speed up the deployment of much-needed solutions, like the Lendable Decarbonization Fund, by bringing together actor networks across DFIs, foundations, commercial investors, and implementers.”

Daniel Goldfarb, Executive Chairman and Co-founder of Lendable.

IMPACT

LDF will start deploying SLL loans in countries where Lendable has an active pipeline, such as Kenya, Uganda, India, Indonesia, and Mexico. The client base can be categorized into Direct users aiming to decarbonize their operations and Enablers selling products or services that help others decarbonize. In order to be eligible for an LDF loan, a clear alignment to SDG13 (Climate action) must be present and supported by a transparent GHG emission thesis. It is projected that at an AUM of USD 250 million, LDF has the potential to support avoidance of 141 million tCO2e.

DESIGN

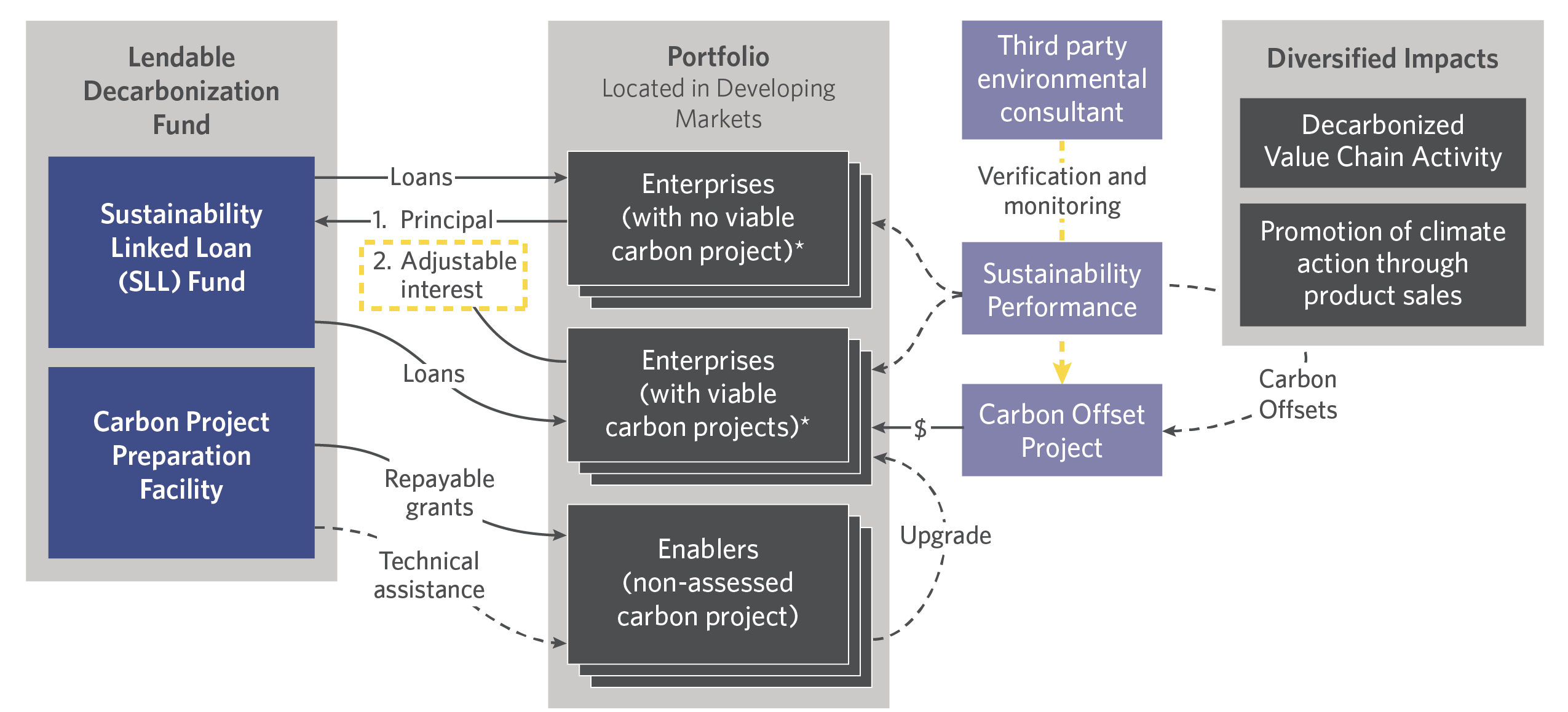

LDF has three key features:

- Sustainability Linked Loan Fund (SLL fund): Deploys SLLs to incentivize pre-agreed sustainability performance targets through an interest adjustment mechanism.

- Maestro application: Lendable’s proprietary technology is embedded into the client’s systems to support loan monitoring and impact tracking, reducing administration costs.

- Carbon Project Preparation Facility (CPPF): Provides technical assistance and funding to support new carbon offset projects.

The SLL fund deploys loans to enterprises that have no viable carbon project and those that do. These companies will be both direct users and enablers. The third box down represents enterprises that qualify for CPPF grants.

The right side of the instrument mechanics illustrates the diversified impacts these enterprises produce. These impacts can be categorized as (a) decarbonized value chain activity or (b) promotion of climate action through product sales or service. Assessed and monitored by a third-party environmental auditor, these impacts will help determine the interest rate adjustments in the SLLs and allow for the successful issuance of carbon credits for companies with carbon project viability.