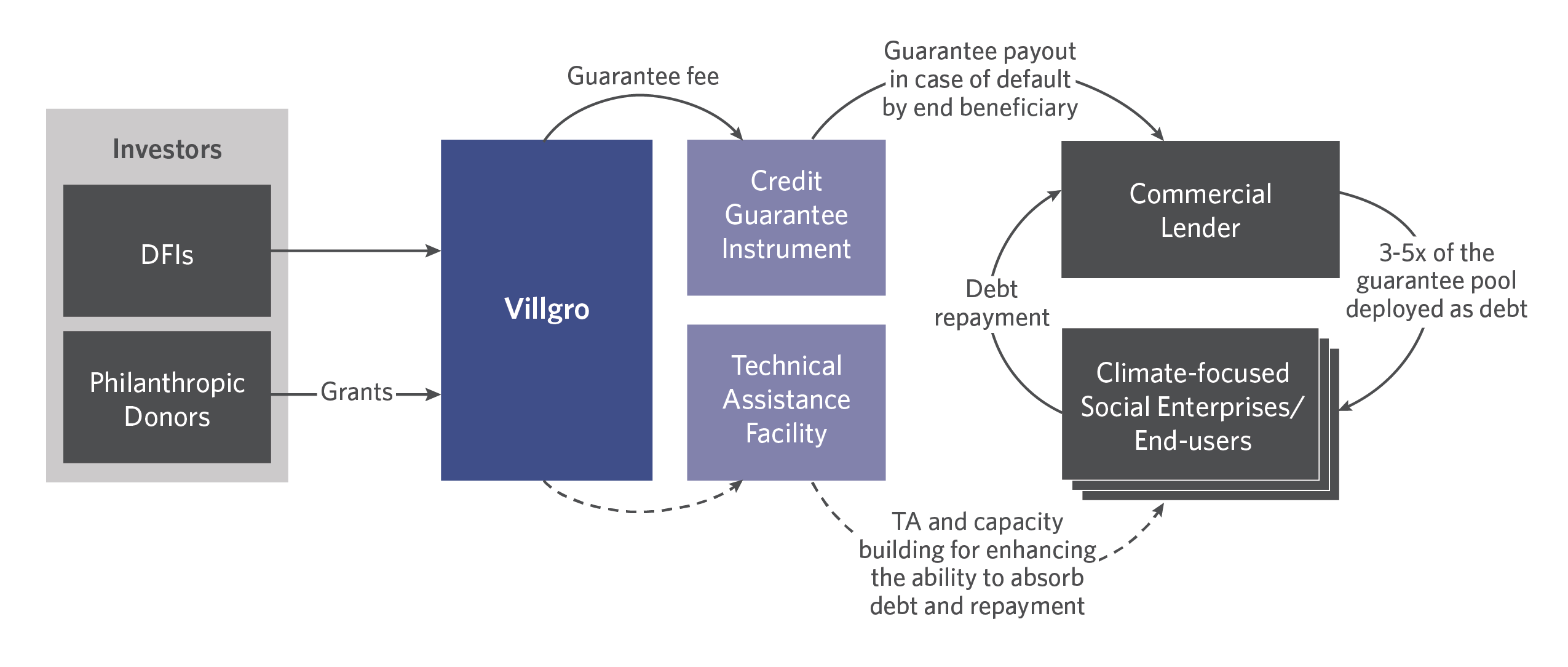

The Impact Financing Facility for Climate-Focused Social Enterprises is a credit guarantee mechanism augmented by technical assistance that helps innovative, new to-credit climate-focused social enterprises and their end users unlock collateral-free commercial debt, build a credit history, and scale operations to create greater impact.

ABOUT

Innovative climate-focused social enterprises are critical for India to achieve its net zero goal. There is a need to support such enterprises in their initial years – especially in availing credit from formal channels.

Financial institutions do not lend to such enterprises as they consider them to have a high degree of credit risk due to their lack of credit history, lack of collateral, and challenging customer segments and target geographies. In India, they have lesser credit access than MSMEs in general, which, as a category, face a credit gap of USD 250 billion.

The Government of India, development finance institutions (DFIs), and philanthropies have tried to address this issue using credit guarantee schemes. However, these schemes require the enterprise to be profitable or have a credit history – criteria many climate-focused social enterprises do not meet.

INNOVATION

The instrument is the first facility in India that provides a portfolio credit guarantee to enable financial institutions to lend to climate-focused social enterprises and their end users who lack a credit history. Unlike other credit guarantees in India, the instrument targets a wide range of sectors. The facility also offers technical assistance to help borrowers improve their financial performance and increase their ability to repay their debt. The goal is to improve the bankability of the enterprises and their end users despite not meeting conventional credit criteria, build their credit history within a short credit cycle to raise funds by themselves, and create social and environmental impact at scale.

“Villgro sees blended finance as a crucial step towards improving access to finance to social enterprises developing innovative climate solutions. The Lab’s experience and expertise in designing, testing, and validating blended finance structures will add the needed credibility to our efforts.”

Vibha Sharma, CA, CFA, Impact Financing Lead at Villgro

IMPACT

Over the next two years, Villgro plans to raise USD 3-5 million to capitalize the guarantee pool. Over the next five years, it will benefit 25,000 end-users, enabling 10,000 livelihoods (including 7,500 gender-centric jobs) and reducing 50,000 tCO2e of emissions. The instrument incorporates a gender lens in selecting beneficiaries and looks to maximize business value for all stakeholders.

DESIGN

The instrument is a portfolio first-loss default guarantee and a technical assistance facility capitalized through grants from private philanthropies and development finance institutions.

The facility will partner with multiple commercial lenders and leverage the guarantee pool 3-5X. The commercial lender will lend to the selected enterprises and end users based on the risk mitigation provided by the credit guarantee.

In parallel, Villgro will provide technical assistance to enhance borrowers’ ability to service the debt and ensure best practices to minimize default.