The Clean Economy Fund (CEF) is a USD 75 million structured equity fund that invests in first-of-a-kind climate technologies. The Fund provides capital and comprehensive commercialization support to scale innovations that can transform industries and decarbonize economic development. CEF will operate across India, funding startups that optimize business performance and curb industrial emissions.

ABOUT

India’s industrial sector accounts for 49.6% of the country’s energy-related emissions and, without a shift to cleaner technologies, could consume a significant portion of the global 1.7°C carbon budget. Many startups are rising to the challenge and developing technologies and business models, some of which are first-of-a kind (FOAK). However, startups valued between USD 1-10 million face a financing gap needed to scale their operations. These companies, which are often infrastructure-intensive or IP-led are considered too risky for commercial lenders, too capital-intensive for early-stage ventures, and not yet large enough for growth equity. The result: promising technologies stall due to high perceived risks, and absence of fit-for-purpose capital and commercialisation support. While India’s policy reforms and green capital markets are improving investor confidence, blended finance is essential to bridge this gap, crowd in private capital, and accelerate industrial decarbonization at scale.

INNOVATION

Green Artha’s Clean Economy Fund (CEF) is India’s first structured equity fund dedicated to decarbonizing economic growth. CEF invests in first-of-a-kind and early-growth climate technologies that struggle to secure financing and scale the commercialisation valley of death. It combines capital with strategic technical assistance to help companies validate business models, build FOAK facilities, establish robust customer pipelines, secure appropriate follow-on funding, and prepare for exits such as sales or SME IPOs. By blending venture-style risk tolerance with private equity discipline, CEF reduces real and perceived risks and improves capital efficiency for both commercial and concessional funders, while demonstrating viable, scalable models.

We look forward to working with the Lab’s global experts and partners to provide market-sounding for startups to scale, replicating the model in other geographies, and accelerating fundraising.

Starlene Sharma, Managing Partner and Co-founder, Green Artha.

IMPACT

CEF aims to cut 15 megatons of CO2e by financing climate solutions in India’s highest-emitting sectors: industry, energy, and the built environment. The pilot fund targets a USD 35M–40M first close, anchored by DFIs and commercial investors, with a full fund size of USD 75 million.

DESIGN

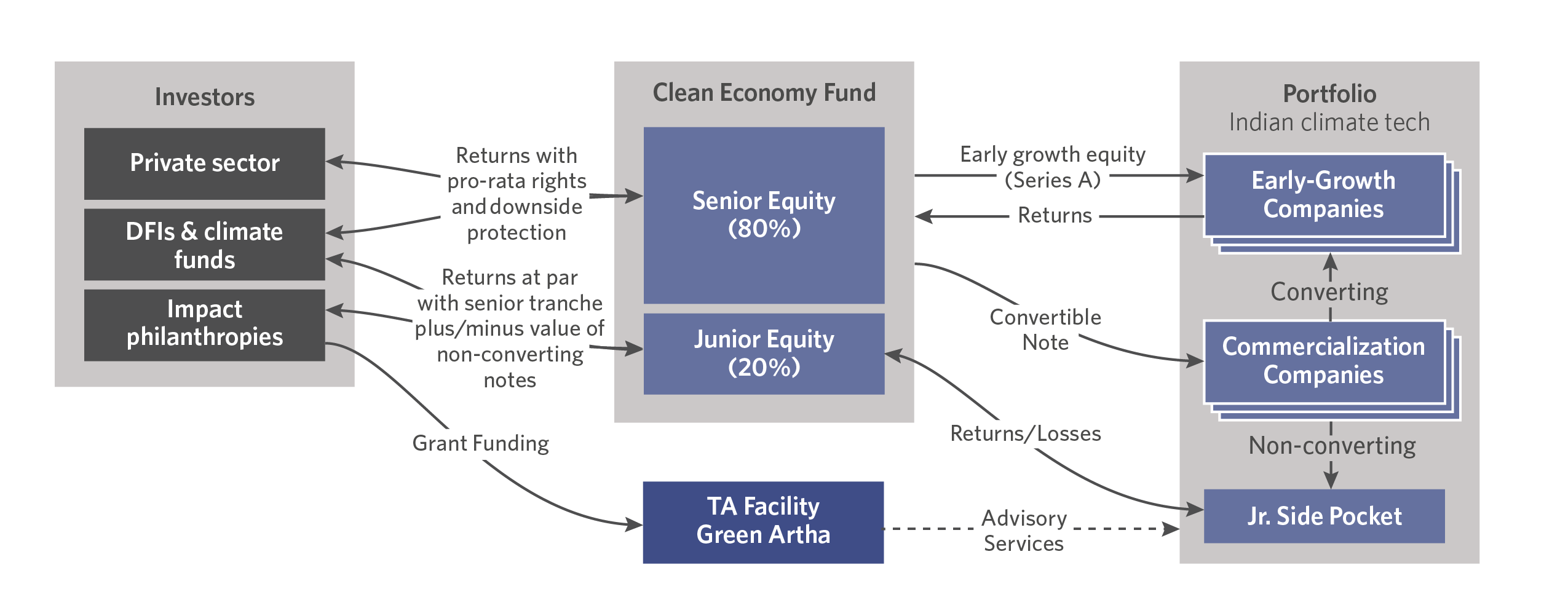

CEF blends 80% senior capital with 20% junior, or concessional capital, to balance risk and return. Junior and Senior capital both participate on a pro-rata basis in all investments. The junior tranche absorbs potential losses while sharing in upside, creating downside protection for senior investors and aligning concessional resources with early-stage risks on an investment-by-investment basis, rather than underwriting the fund manager. This structure provides the risk-adjusted returns needed to crowd in commercial capital while still supporting high-potential FOAK technologies.

The fund invests through convertible notes and equity, tailored to company maturity. Pre-growth firms, requiring more de-risking, receive a USD 1 million note plus commercialization support, followed by up to USD 4-5 million in growth equity if milestones are met. Early-growth firms that are more ready to scale receive up to USD 5 million upfront, with a maximum of USD 6 million over the fund’s life. Convertible notes give flexibility: they convert to equity once the company achieves a qualified financing round, typically demonstrating that the company has been derisked and is ready for scale-up.