A USD 100 million digital green banking fintech providing asset and micro-finance to climate mitigation Micro-, Small and Medium-sized Enterprises (MSMEs), facilitating both debt and carbon transactions with a presale of carbon credits to buy down interest rates. Initial targets are Kenya, and Uganda, with expansion plans to neighboring markets.

ABOUT

Small and Medium Enterprises (SMEs) are central to Africa’s green transition, sustaining 80% of livelihoods and driving the adoption of clean technology products and business models. Yet many are stuck in the missing middle: limited to expensive microloans under USD 10,000, while their real financing needs range from USD 20,000 to USD 1 million. Even mid-tier carbon developers often cannot access debt, hampering the rollout of sustainable water, energy, and e-mobility projects across communities. Delayed clean technology investment exacerbates climate vulnerability, with the most severe impacts anticipated in agricultural value chains—now also subject to carbon border adjustments.

Leveraging digital technology and rising demand for high-integrity carbon credits could unlock access to affordable, scalable capital for thousands of SMEs, driving resilient growth in Africa’s green economy.

INNOVATION

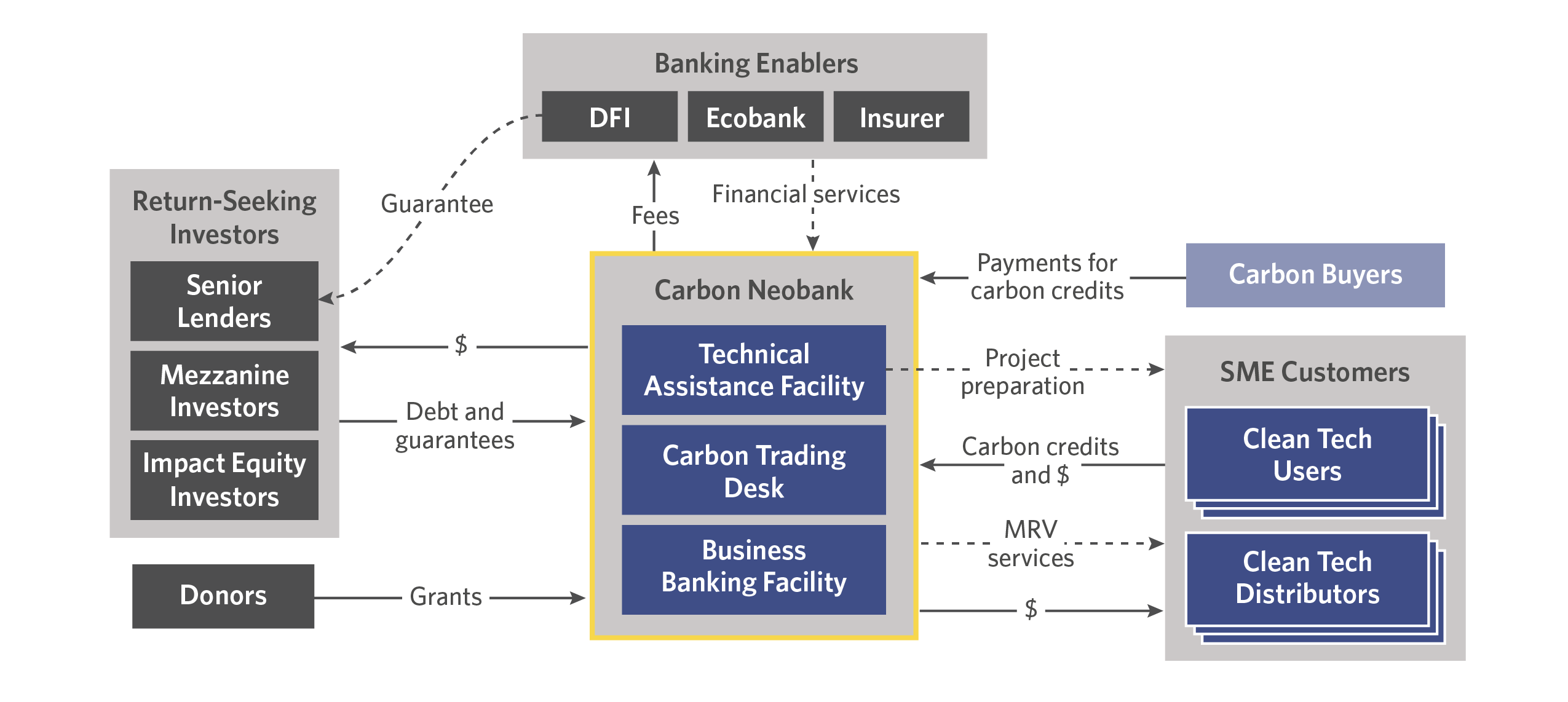

Carbon Neobank is a fully digital carbon bank designed to help African green SMEs access affordable, flexible financing to support sustainable growth.

It integrates carbon finance into mainstream banking products, incentivizing the distributors of clean technology (enablers) and transforming future carbon revenues into bankable assets for operators (direct users). A suite of working capital and carbon-backed financial products supports SMEs across life stages, enabled by digital monitoring tools that accelerate underwriting, reduce risk, and streamline compliance.

By aggregating small-scale projects and leveraging new digital MRV-enabled carbon methodologies, Carbon Neobank bridges the gap between SMEs and international buyers of high-quality carbon credits. This approach strengthens African value chains while fostering a just transition to a low-carbon economy.

“We applied to the Lab because we recognize the need for specialized expertise and technical assistance in climate finance—particularly in financial engineering and carbon modeling. The Lab provides the ideal platform for the guidance, validation, and resources to strengthen our solution and accelerate its adoption.”

Mélanie Keïta, CEO, Melanin Kapital.

IMPACT

Carbon Neobank’s pilot will support around 225 green SMEs in Kenya and the region, enabling them to sustainably expand operations. The approach prioritizes inclusive growth by aligning investor returns with real climate and social impact.

A key feature of the pilot is its ability to attract private capital: 50-70% of funding is expected to come from private investors. This demonstrates how innovative structures can leverage limited concessional funding to unlock larger flows of commercial finance.

The pilot’s impact is significant. Supported SMEs are expected to cut more than 5.2 million tCO2e, generate 35,000 MWh of renewable energy, distribute 175,000 clean cooking devices, and recycle over 18,000 tons of waste.

DESIGN

Carbon Neobank combines three components:

- A business banking facility providing receivables finance (USD 50k+), unsecured working capital facilities (up to USD 500k), and carbon-backed term loans (up to USD 1M)

- A carbon trading desk that ensures fair value from carbon credits and arranges insurance to reduce financial risk

- A technical assistance facility covering grouped carbon project setup and emission reduction verification costs, recovered as credits are generated.

Efficiency is achieved through aggregation of small-scale projects and directly integrating with carbon standards bodies, using accurate, low-cost digital MRV methodologies aligned to the Core Carbon Principles and compliance market requirements. Monetized emission reductions are real, measurable and additional. Equity is promoted through transparent carbon revenue sharing with SMEs, maximized through premium buyer networks.

This holistic approach overcomes common challenges in carbon finance, including high transaction costs, substantial risk premia, and fixing future value in a volatile environment.

Carbon Neobank has exceptional catalytic potential owing to its partnership with banking heavyweight Ecobank, scalable digital backbone, and embedded credit enhancement features – such as loan collateralization, insurance, and credit guarantees. These features strengthen appeal for impact-seeking private investors, both domestic and international.