The Price Risk Facility addresses the challenges of price volatility in agriculture, which significantly impact the financial stability of smallholder farmers and agribusinesses. The Facility aims to increase access to finance and reduce the risks faced by vulnerable groups while tackling post-harvest losses. It provides financial security by allowing recipients to invest in climate-smart practices and technologies, leading to increased productivity, improved livelihoods, and resilient food systems.

ABOUT

In India, agriculture remains the primary livelihood for 40% of the population, yet the sector contributes only 18% to GDP. Landholdings are highly fragmented, with 86% of farmers being smallholders managing less than two hectares. Despite programs such as Priority Sector Lending, just 30% of smallholders access institutional credit, while most depend on informal loans. This lack of affordable finance leaves farmers vulnerable to climate shocks and price fluctuations, limiting investments in technology and quality inputs. Annual food losses amount to USD 18.5 billion, mainly at the farm level. While India’s crop insurance scheme covers production risks, farmers remain exposed to price risks, leaving them unable to build resilience or adapt effectively.

INNOVATION

The Price Risk Facility fills a critical gap in agricultural finance by directly addressing price volatility, a risk largely overlooked in emerging economies. While traditional agricultural insurance has focused almost exclusively on production risks, this facility targets income stability for smallholder farmers. Building on this, Agtuall partners with lenders and insurers to integrate price insurance into the agriculture lending ecosystem, aiming to improve creditworthiness and strengthen resilience across India’s agricultural sector.

The Lab’s strong track record in public-private initiatives made it the ideal platform. Seeing past successful projects and gaining support in formalizing the financial structure and valuable exposure to its members made us determined to join.

Vikram Sarbajna, Founder & CEO, Agtuall.

IMPACT

Agtuall has built a validated pipeline for its Price Risk Facility, protecting farmers and lenders from price volatility by bundling price insurance into agri-loans. Pilots with NBFCs and one of India’s largest private banks have enabled USD 5+ million in credit for 11,000 farmers. With proven feasibility and insurer participation, Agtuall will establish a legal entity and raise USD 2 million in grants to capitalize a temporary risk pool. By 2026, Agtuall targets USD 100+ million in loans enabled for 200,000 farmers, scaling to USD 500 million for 600,000 farmers across India by 2028.

DESIGN

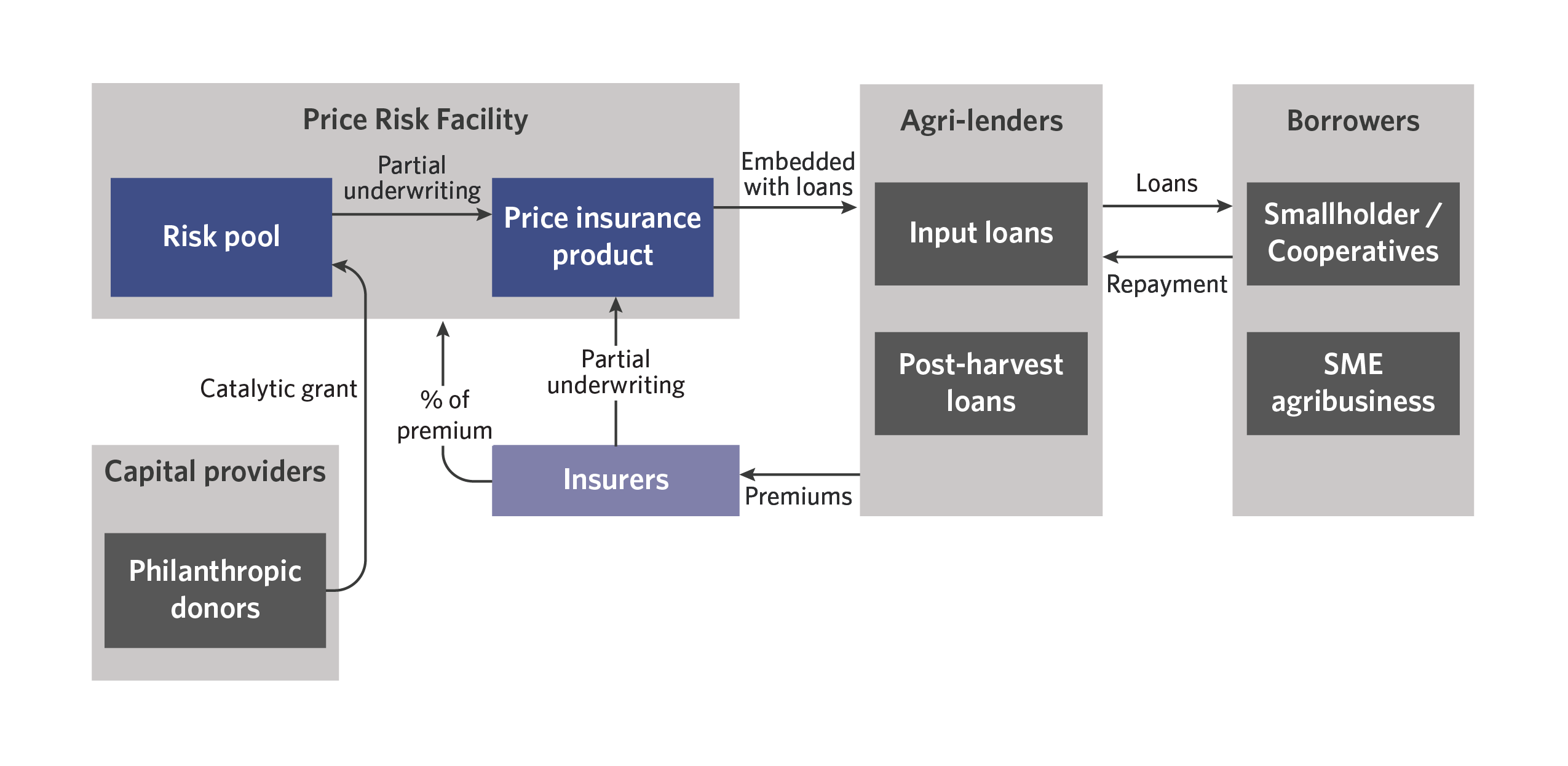

The Price Risk Facility is designed to stabilize farm incomes and reduce lender risk by linking insurance payouts directly to agricultural loans. Insurers underwrite policies for lenders, who issue loans to farmers for input or post-harvest purposes. At the time of issuance, a strike price for the commodity is set, ensuring coverage for the full loan period. If prices fall below this threshold, a payout is made to the lender, who then adjusts the farmer’s repayment schedule. This mechanism protects farmers from income shocks, enables them to avoid default, and improves their ability to invest in inputs and technology. For lenders, it reduces credit risk, encouraging them to extend financing to smallholders.

The Facility also incorporates a risk pool that co-underwrites 10-30% of payouts, fully funded through grants. This additional layer of support reduces insurers’ exposure, building confidence in the product’s early stages. Premiums collected sustain operational and technical functions, while the grant-backed pool catalyzes market entry and scale.