LONDON — The Lab – a public-private initiative composed of experts in sustainable investment from governments, development finance institutions, and the private sector – has picked a new class of investment vehicles to drive much-needed finance to low-carbon, climate-resilient global development, out of over 100 ideas submitted into a competitive pool. The nine new instruments tackle persistent investment barriers in clean energy, low-carbon transit, and sustainable land use in developing countries, with a specific focus on Brazil and India.

Since its start in 2014, the Lab has launched 25 finance instruments that have mobilized nearly USD $1 billion in sustainable investment to date, including $228 million from Lab members. Lab members include the funders of the Lab: Bloomberg Philanthropies, the David and Lucile Packard Foundation, the German Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety (BMUB), the Netherlands Ministry for Foreign Affairs, Oak Foundation, the Rockefeller Foundation, Shakti Sustainable Energy Foundation, the UK Department for Business, Energy & Industrial Strategy, and the U.S. Department of State. Lab members also include other experts from Africa Finance Corporation, the Asian Development Bank, Bank of America Merrill Lynch, Blackrock, the Brazilian National Development Bank (BNDES), CAIXA, Climate Investment Funds, Development Bank of Southern Africa, Deutsche Bank, Inter-American Development Bank, HSBC, OPIC, Willis Towers Watson, the World Bank Group, and the Brazilian, Indian, and Rwandan governments, among many others.

New class of instruments:

CLEAN ENERGY

The Distributed Energy for Social Housing Fund aims to increase clean energy access for low-income communities in Brazil, by installing third-party owned distributed solar generation systems in low-income housing condominiums, and renting the energy generated to the tenants as a part of the condominium fee. Proposed by Endless AB and E-gás Ltda, the Distributed Energy for Social Housing Fund has the potential to generate 155 MW of distributed solar power, and attract USD $186 million of investment by the end of 2024.

Green Aggregation Tech Enterprise (GATE) aims to increase clean energy access in Sub-Saharan Africa by acting as an aggregator and project development toolbox for mini-grids, providing a clear and consistent pricing signal and certainty of offtake to mini-grid generators through a standardised payment system. By doing so GATE intermediates and decreases the tariff gap between the mini grid and the main grid, enabling the investment needed for mini-grids to be a scalable solution.

The Residential Rooftop Solar Accelerator aims to increase residential rooftop solar power in India by leasing solar rooftop systems to households that do not have the required credit history to purchase them, and by leveraging data and technology to achieve scale and lower customer acquisition costs. Proposed by Sangam Ventures, the idea can help the adoption of solar as the preferred energy solution at the household level in India.

SUSTAINABLE LAND USE

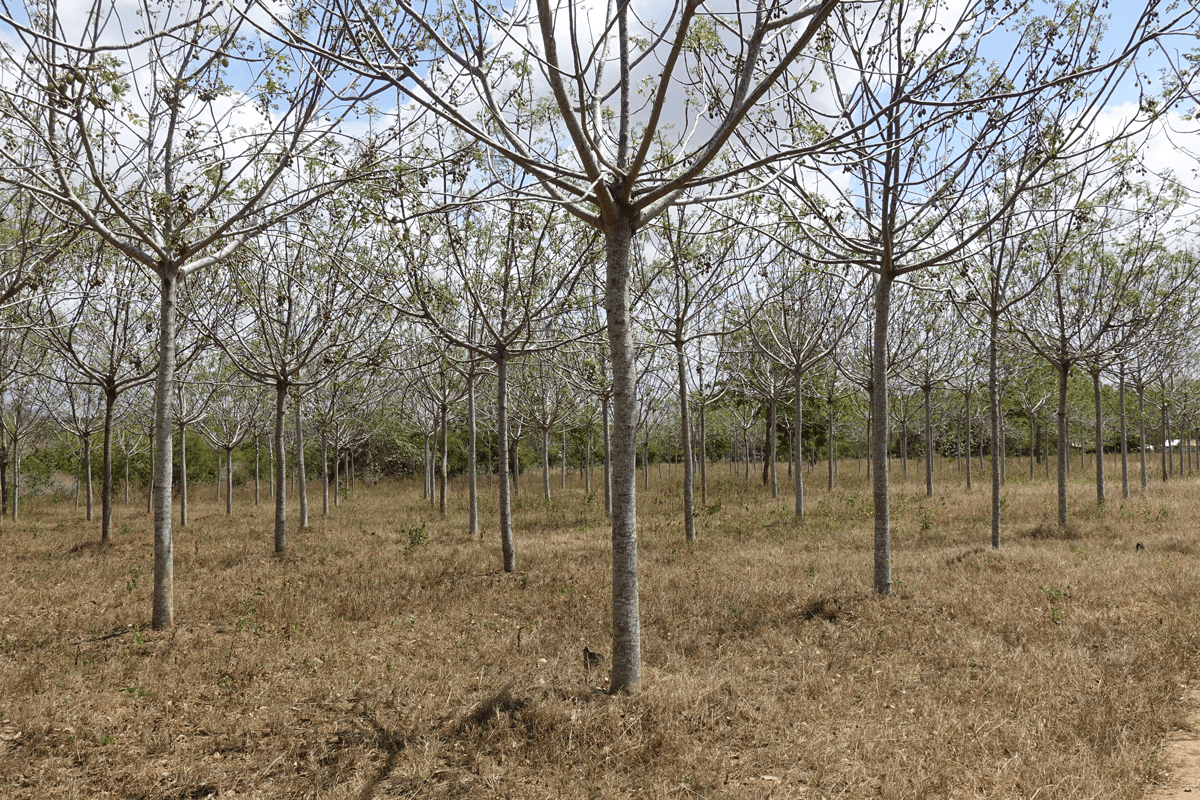

The Harvest Contract Vehicle (HCV) for Smallholder Tree Financing seeks to finance smallholder farmers to create a more sustainable wood supply while generating income for farmers, with a contract-based tree farming program that attracts long-term investors. Proposed by Komaza, this idea could potentially help restore degraded landscapes and reduce pressure on existing forests in Kenya, and provides wealth creation opportunities for smallholder farmers along the 10-15 year program period.

The Responsible Commodities Facility aims to increase the production and market demand for deforestation-free, Forest Code-compliant commodities in Brazil, initially focusing on soy, through incentives to plant in deforested and degraded lands. Proposed by BVRio, the Facility could accelerate the growth of zero-deforestation soy in the Cerrado region of Brazil, and also has the potential to generate a demand of finance of up to USD $3.4 billion, over an initial five years of operation.

The Socio-Climate Benefits Fund Facility aims to increase forest restoration in the Amazon by providing long-term loans and technical assistance to smallholder low-carbon protein farmers (fish/poultry/pig) for sustainable agroforestry practices. Kaeté Investimentos, which proposed the instrument, will facilitate “take-or-pay” contracts between the farmers and buyers interested in sustainable agroforestry products, guaranteeing and diversifying revenue for the farmers and incentivizing sustainable agroforestry practices.

LOW-CARBON TRANSIT

Financing for Low-Carbon Auto Rickshaws aims to increase sustainable transit in India, by financing asset loans for low carbon and electric auto-rickshaw drivers that leverage financial and digital technologies, such as real time information and payment systems. Proposed by Three Wheels United, the idea will not only decrease emissions from auto rickshaws but will also increase the income of drivers by giving them independence from renting.

Pay-As-You-Save for Clean Transport aims to accelerate clean transit in cities, by lowering the upfront costs of electric buses via a Pay-As-You-Save mechanism where a utility invests in the upfront upgrades – on-board batteries and charging stations – and recovers those costs with a charge on the customer’s bill that is less than the estimated savings. The idea proponent, Clean Energy Works, is targeting initial pilots in South Africa and India.

The Long-Term Debt Facility for Traction Batteries aims to reduce the total ownership cost of electric buses in India, by generating additional revenue from repurposing traction batteries as energy storage batteries after the end of the traction period, which would enable the use of the battery for another 5-10 years. Proposed by Mytrah NN4Energy, this idea could lower the cost of electric bus deployment and help deploy 5,000+ electric buses in India per year.

The nine ideas will now move forward in the Lab’s 2018 cycle for analysis, stress-testing, development, and preparation for launch at the end of the year. For more information, visit: www.ClimateFinanceLab.org