Agri-Smallholder Resilience Fund (ASRF) finances climate-smart agriculture and aquaculture projects. The Fund boosts rural incomes and access to affordable fresh produce for households and big businesses.

ABOUT

The Philippines’ agriculture underpins food security and rural livelihoods but faces deep structural and financial constraints. Smallholder farmers and fishers, who supply most staple crops and coastal catch, are highly vulnerable to climate shocks but are largely excluded from formal finance, receiving only 2.6% of total bank lending. With fewer than 30% accessing formal credit, many rely on informal lenders charging up to 30% monthly interest, fueling an agricultural credit gap of about USD 7 billion. Weak logistics, high post-harvest losses, insecure land tenure, and limited agronomic support compound risks, reinforcing lenders’ perception that smallholders are unbankable. These barriers perpetuate underinvestment, debt cycles, and vulnerability in a sector critical to climate resilience and national food security.

Despite this, HIF preservation has historically been difficult to monetize, with value only assigned when HIFs are degraded to make way for infrastructure, agriculture, pasture, or extractive industries. Both land stewards and investors have lacked financial incentives to protect and/or restore forests.

INNOVATION

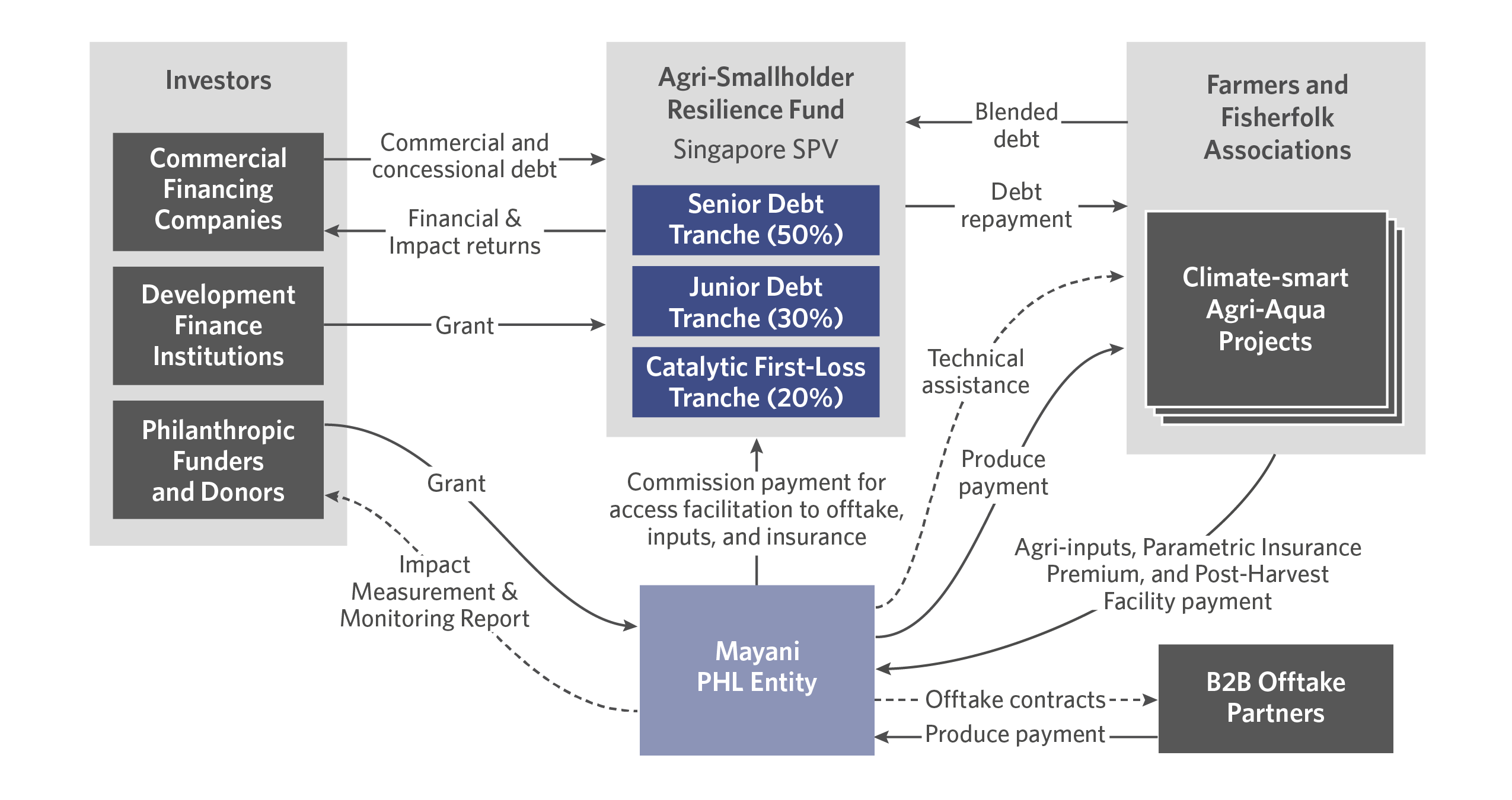

The Agri-Smallholder Resilience Fund (ASRF) is the first blended finance vehicle in the Philippines, designed exclusively for agri-smallholders. It uniquely combines parametric insurance, agronomic support, and corporate offtake agreements to de-risk lending and build climate resilience. This integrated model transforms smallholders into strong claimholders of rural development, narrowing the USD 7 billion financing gap while building resilience, productivity, and investability across Philippine agriculture.

Mayani sees the Lab as a platform and a crucial co-development linchpin through which we can mobilize capital, glean expert insights, and acquire nuanced technical support in developing our Fund to build smallholder resilience in rural areas of the Philippines.

JT Solis, Co-Founder & CEO, Mayani.

IMPACT

ASRF will launch with a USD 1 million pilot in northern Luzon, supporting 2,800 smallholders (30% women) through climate-smart inputs, parametric insurance, cold storage, and secured offtake agreements. The pilot is expected to raise incomes by 30%-50%, cut post-harvest losses by 20%, and reduce 4,400–10,600 tons CO2e annually. Once fully capitalized, the USD 22.5 million fund is projected to scale these benefits to 8,800 smallholders over five years, using a layered capital stack that matches diverse investor risk-return profiles. Expansion will follow a phased rollout across Luzon, Visayas, and Mindanao, tailored to local conditions.

DESIGN

ASRF aggregates investment from commercial investors, DFIs, and philanthropic sources into a Singapore-based SPV, ensuring institutional-grade governance and enforceability. Capital is deployed through cooperatives to finance climate-smart inputs, post-harvest infrastructure, and bundled risk-mitigation elements such as parametric insurance, agronomic support, and offtake agreements, directly reducing production and market volatility.

The vehicle integrates core lending with complementary services to address structural barriers to smallholder finance. ASRF generates revenue through four channels: (1) interest payments on loans, (2) parametric insurance commissions, (3) cold storage service fees, and (4) supply chain facilitation revenues. These recurring cash flows create a self-sustaining cycle of reinvestment, expanding financial access while strengthening resilience.

Oversight is ensured by an Independent Advisory Board, with transparent reporting on key metrics, including loan delinquency, yield improvements, and insurance uptake. By bridging impact and bankability, ASRF offers scalable climate and livelihood benefits while de-risking agricultural finance for investors.